Material Handling Equipment Market Size, Share, Trends & Growth Forecast to 2032

The global material handling equipment market size was valued at USD 239.3 billion in 2024 and is projected to reach USD 390.88 billion by 2032, growing at a CAGR of 6.4%. Explore key drivers, trends.

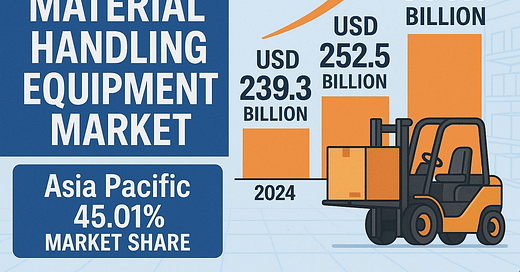

The global material handling equipment market size was valued at USD 239.3 billion in 2024. It is projected to grow from USD 252.53 billion in 2025 to USD 390.88 billion by 2032, exhibiting a steady CAGR of 6.4% during the forecast period. The Asia Pacific region continues to lead the global material handling equipment market share, accounting for 45.01% in 2024, driven by rapid industrialization, warehouse automation, and expansion in manufacturing and e-commerce sectors.

📊 Material Handling Equipment Market Snapshot

2024 Market Size: USD 239.3 Billion

2025 Estimate: USD 252.53 Billion

2032 Forecast: USD 390.88 Billion

CAGR: 6.4% (2025–2032)

Dominant Region: Asia Pacific — 45.01% share in 2024

✅ Key Material Handling Equipment Market Drivers

Automation & Smart Warehousing: Increasing adoption of automated guided vehicles (AGVs), robotics, and IoT-driven solutions fuels overall market growth, optimizing operations in warehouses and distribution centers.

Rising E-commerce & Retail Expansion: The boom in online shopping and omnichannel retail is boosting demand for advanced storage equipment and transport equipment, driving the market size further.

Infrastructure Development & Industrialization: Rapid industrial growth in emerging economies, especially across Asia Pacific, strengthens material handling equipment market share through large-scale warehousing and logistics hubs.

⚠️ Key Material Handling Equipment Market Restraints

High Initial Investment Costs: Large capital expenditure for automation solutions and robotics systems can limit adoption, especially for small and medium-sized enterprises.

Maintenance & Downtime Challenges: Ongoing servicing and downtime for complex machinery may impact operational efficiency and hinder market growth.

Fluctuating Raw Material Prices: Instability in steel and electronic components pricing affects manufacturing costs, squeezing margins for equipment providers.

🚀 Material Handling Equipment Market Opportunities

Sustainability & Green Logistics: Growing focus on eco-friendly forklifts and energy-efficient warehouse systems opens up new revenue streams for manufacturers.

Expansion of Smart Factories: The integration of Industry 4.0 and connected solutions will transform the material handling equipment industry, offering significant market opportunities for intelligent systems and data-driven decision-making.

Emerging Markets Growth: Untapped potential in regions like Southeast Asia, Latin America, and Africa presents opportunities for local manufacturing, distribution, and service partnerships.

🔑 Top Material Handling Equipment Companies

Daifuku Co., Ltd. (Japan)

Liebherr Group (Switzerland)

Toyota Industries Corporation (Japan)

Jungheinrich AG (Germany)

Kion Group AG (Germany)

Hyster-Yale Materials Handling, Inc. (U.S.)

Crown Equipment Corporation (U.S.)

Mitsubishi Logisnext Co., Ltd. (Japan)

KUKA AG (Germany)

Beumer Group, Swisslog Holding AG, Godrej Group & more

Key Developments:

February 2024: Bobcat expanded its product portfolio by integrating Doosan Industrial Vehicle, rebranding forklifts and warehouse equipment to reach new customer segments.

January 2024: CLARK Europe GmbH unveiled green electric forklifts and new electric counterbalance trucks, highlighting sustainability trends in the material handling equipment market.

🔍 Read the Full Material Handling Equipment Market Report

Stay ahead of trends, growth drivers, and key players shaping the future of the material handling equipment industry:

👉 Read Full Report https://www.fortunebusinessinsights.com/industry-reports/material-handling-equipment-market-101501