Global Electric Construction Equipment Market Insights, Size & Forecast 2023–2032

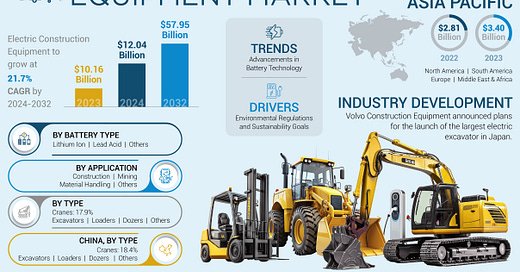

The electric construction equipment market Valued at USD 10.16 billion in 2023 & is projected to grow to USD 57.95 billion by 2032, at a rapid CAGR of 21.7% during the forecast period.

In recent years, the Global Electric Construction Equipment Market has witnessed notable growth, fueled by rapid technological advancements and rising global demand. This comprehensive report delves into emerging market trends, key growth drivers, and detailed segmentation across [key segment categories].

The global electric construction equipment market size was valued at USD 10.16 billion in 2023. The market is projected to grow from USD 12.04 billion in 2024 to USD 57.95 billion by 2032, exhibiting a CAGR of 21.7% during the forecast period.

Get your free sample report PDF brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/108017

The electric construction equipment market is growing as industries prioritize sustainability and efficiency. AI-powered battery management, zero-emission machinery, and smart energy solutions are driving market demand. With stringent emission regulations, electric construction equipment adoption is increasing.

Top Players in the Electric Construction Equipment Market

Leading companies shaping the semiconductor machinery industry include Caterpillar Inc. (U.S.), Komatsu (Japan), AB Volvo (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Deere & Company (U.S.), Sany Heavy Industry Co., Ltd. (China), JCB (U.K.), HD Hyundai Infracore Co., Ltd. (South Korea), Kobelco Construction Machinery Co., Ltd. (Japan), Liebherr (Switzerland), Xuzhou Construction Machinery Group Co., Ltd. (China) and other major market participants.

Key highlights of the Report:

• Market Performance

• Market Outlook

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

What comprehensive insights does the research report on Electric Construction Equipment provide, and which regions are analyzed in detail?

The research report on Electric Construction Equipment offers an in-depth and strategic evaluation of the market, delivering valuable insights into upcoming trends, key growth drivers, supply and demand dynamics, year-over-year (Y-o-Y) growth rates, compound annual growth rate (CAGR), and pricing trends. It leverages a range of analytical tools and models including Porter’s Five Forces, PESTLE Analysis, Value Chain Analysis, the 4 Ps Framework (Product, Price, Place, Promotion), Market Attractiveness Index, BPS (Basis Point Share) Analysis, and Ecosystem Mapping to ensure a holistic market understanding. Furthermore, the report presents a detailed regional breakdown, covering key geographic markets such as:

North America (U.S., Canada, Mexico)

Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

These insights empower stakeholders to understand market dynamics, identify growth opportunities, and make strategic decisions across regions.

What Are the Recent Developments in the Electric Construction Equipment Industry?

Volvo Construction Equipment (Volvo CE) shared plans to introduce the largest electric excavator in Japan, emphasizing the company's commitment to sustainability and innovation in construction machinery. This launch aims to meet the growing demand for eco-friendly equipment in the Japanese construction industry.

Sumitomo Corporation's subsidiary, Sunstate Equipment Co. completed 100% acquisition of Trench Shore Rentals, Inc., a leading U.S. trench safety equipment rental company, with an objective to expand their construction equipment business.

Hitachi developed an electric excavator that can operate for 10 hours on a single charge. The excavator is expected to be a game-changer in the construction industry.

Volvo achieved the target of a 45% reduction in CO2 emissions from their vehicles. The company is heavily investing in electric and hybrid construction equipment.

Caterpillar Inc. launched Cat 794AC, an electric drive articulated truck with improved efficiency and productivity in the construction industry.

About Fortune Business Insights™

Fortune Business Insights™ provides data-driven insights and reliable research analysis to support businesses of all sizes. Our reports are designed to help clients navigate market uncertainties, unlock new growth avenues, and make confident, informed decisions.